Protective Executive UL

Protective Executive 10-Year Term

Protective Executive UL (EUL)

Protective Executive 10-Year Term (E10)

LIFE INSURANCE FOR HIGHLY COMPENSATED individuals

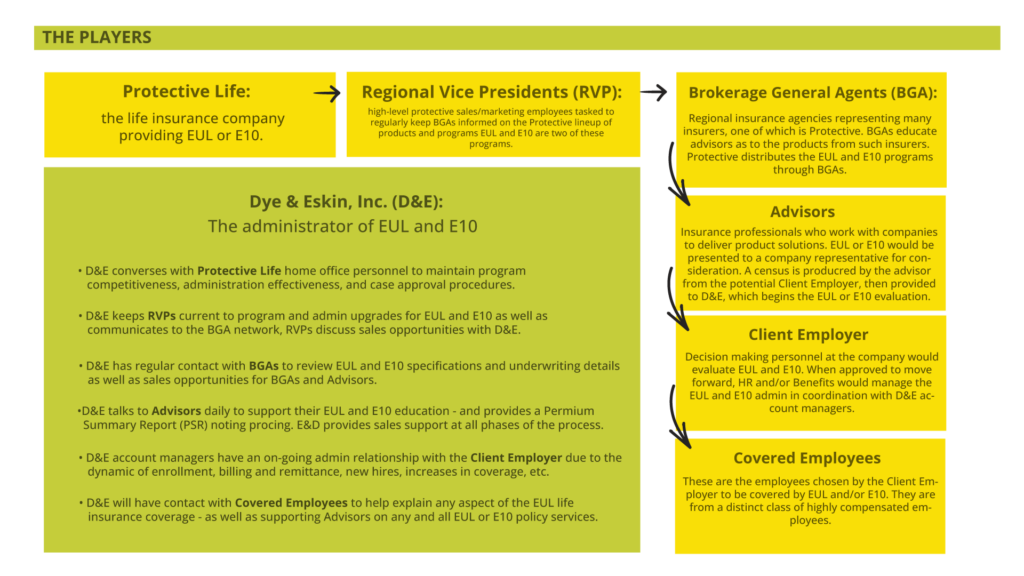

EUL and E10 are each an institutional purchase (employer paid) life insurance program on the lives of a distinct group of highly compensated employees without exception, delivered by the issuance of individual insurance policies, underwritten on a guarantee issue type basis.

[ key facts ]

Insurer

EUL and E10

Opportunities for the Client Employer (And the Advisor)

- Carve-out of Group Term

- Additional Insurance

- Replace other carve-out plans

- Corporate Situations (Buy-Out or Key Man)

Replace Other Plans: Why?

- ExtendCare (EUL, only): No other carve-out plan has this type benefit.

- EUL Pricing: Depending upon demographics, generally 18% – 25% lower.

- E10 Pricing: Depending upon demographics, generally 10% – 20% lower than other 10-Year Level Carve-out competitors.

- Portability: No restrictions. Partner/Employee can port policy – no change in death benefit nor premium schedule.

- Maximum Death Benefit: Up to $5,000,000 (some restrictions apply). Many competitors will not go this high.

[ Sales Opportunities ]

Executive UL Cases

Opportunity:

Carve Out

A better model of coverage for employees

Industry:

Accounting Firm

Employer had group term life for all employees. Carved out employees earning $100,000 or more (52). Benefit design: two (2) times salary to $1,000,000.

Portable without changes. No reductions at 65, 70, or 75. Group insurance rate reduced.

Opportunity:

Create More Coverage

Obtaining more death benefit

Industry:

Law Firm

The group term coverage could not deliver enough death benefit. Partners in the law firm (84).

Partners provided $5,000,000.

Opportunity:

Replace Competitor Plan

Obtaining lower cost and better provisions

Industry:

Hospital

The hospital had a group variable universal life program. Confusing and an administration nightmare.

Changed to Executive UL:

Opportunity:

Corporate Needs

“Individual” Policy type allowed for Corporate Ownership

Industry:

Investment Firm

Fund their existing stock redemption plan.

Owner: Employer

Insured: Employee and Stockholder

Beneficiary: Employer

Able to insure a specific formula (up to a maximum of $1,800,000) to 36 employees. Able to provide for future benefit increases

.

[ resources ]

E10 MARKETING PIECES